The United States of America boasts the world’s largest economy, with larger state economies propelling the country toward success. For instance, if California were an independent nation, its economy would surpass that of India, making it incredibly significant in terms of size and influence.

In order to tap into the potential of the American market, most international companies that are successful in the US hire local employees. However, the high costs associated with doing business in the US can be a barrier for companies. Luckily, there are several ways to hire US employees, with a PEO (Professional Employer Organization) being one of them. A PEO is a co-employment arrangement that allows companies to outsource their human resources responsibilities, including compliance with employment law, to a third-party organization.

What is a PEO?

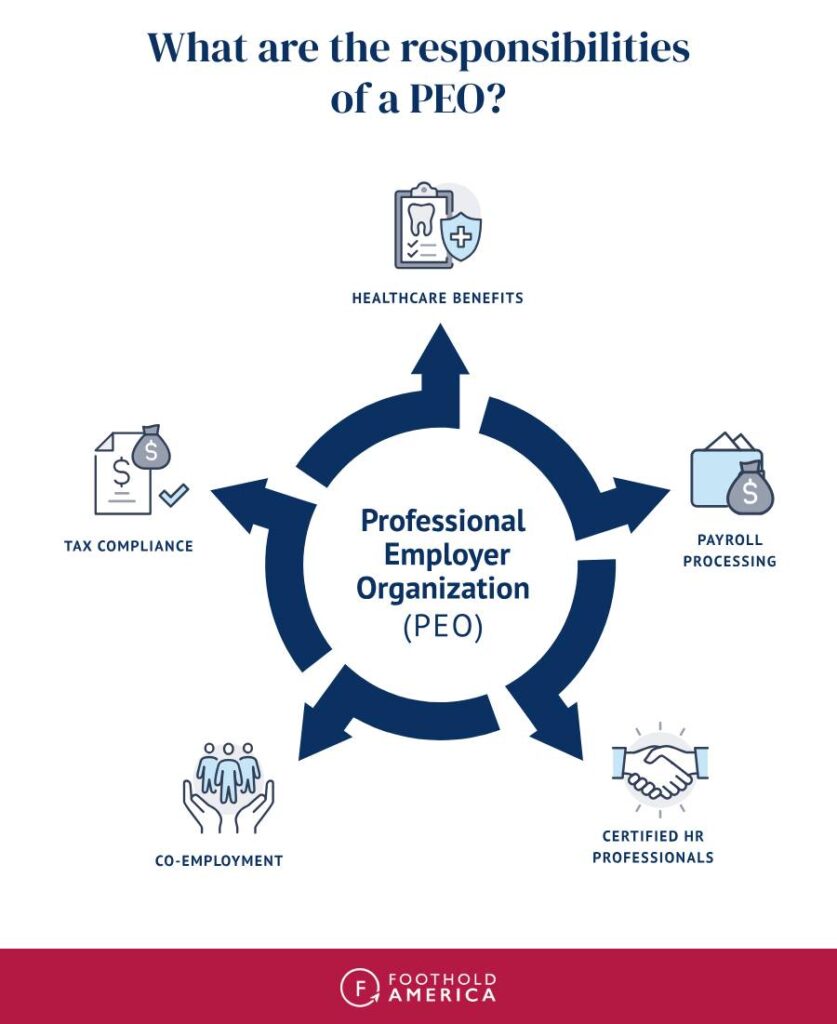

A PEO, or Professional Employer Organization, is a company that provides comprehensive HR solutions and services to small businesses and medium-sized businesses. These services can include payroll processing, employee benefits, risk management, compliance assistance, recruitment and training, and other HR-related functions. Essentially, a PEO acts as an outsourced HR department for its clients, allowing them to focus on growing their business while the PEO takes care of the administrative burdens associated with managing employees. By working with a PEO, business owners can often save time and money, while also gaining access to expertise and technology that may otherwise be too costly or complex for them to implement on their own. Employee training is also a key service provided by PEOs, ensuring that small businesses have well-trained and knowledgeable employees to support their growth and success.

What does a PEO offer?

A PEO offers a range of HR outsourcing tasks for business owners.These include:

- Payroll: This includes maintaining workers’ compensation coverage and employee withholding taxes.

- Taxes: PEOs handle the filing and payment of local, state, and federal employment taxes. They assist with employment-related tax compliance, protecting businesses from potential tax errors and the associated consequences from the IRS.

- Benefits administration: Some PEOs provide employee benefits administration, including health, dental, vision, life insurance and disability.

- Retirement planning: PEOs can manage retirement benefits, offering support with tasks like 5500 filings and 401(k) enrollment.

- Human resources: Some PEOs provide comprehensive talent management services, covering recruitment, training, and performance reviews. Some PEOs also onboard and offboard employees.

- Compliance issues: PEOs can guide companies on some compliance matters, such as ensuring adherence to labor laws.

How does the co-employment relationship with a PEO work?

When a company decides to engage with a PEO, they enter into a co-employment arrangement. In this arrangement, both the PEO and the client share employer responsibilities and liabilities, as outlined in a PEO agreement (also known as a PEO client service agreement).

The client company maintains ownership and control over its operations, including day-to-day management of employees and activities such as product development, marketing, sales, and service. On the other hand, the PEO takes on HR administrative tasks, such as employee recordkeeping, employee benefits management, payroll processing, and employment tax responsibilities.

The agreement also determines the employees that are covered under the co-employment arrangement and establishes compliance obligations for both the client company and the PEO.

While both parties have compliance obligations, PEOs typically assume much of the liability for employment-related matters such as risk management, human resource management, payroll taxes, and employee tax compliance. This can provide business owners with peace of mind.

How much does a PEO cost?

The cost of a PEO varies depending on factors such as the number of employees and the specific services used. Businesses with 20-75 employees are the sweet spot for full-service PEOs, unlocking their full potential to handle all HR needs.

Industry experts estimate that PEO costs typically range between 2-12% of wages. However, it’s important to note that this is an average range, and the actual cost may vary based on the unique needs and circumstances of each business.

It’s worth mentioning that PEO pricing structures can vary, with options such as a flat fee per employee per month or a percentage of the payroll. The pricing structure may impact the overall cost and the flexibility it offers as the business grows.

Remember that the cost of a PEO should be evaluated in relation to the value and benefits provided, including services like administrative support, employee benefits management, payroll processing, and risk management.

Does a PEO replace the HR department?

No, a PEO does not replace the HR department. Instead, outsourcing to a PEO is about working together with your existing HR team to enhance your HR functions and ensure compliance with regulations.

With a PEO, your HR team can focus on more strategic matters that require a deep understanding of your company and its goals, as the PEO takes care of tasks that can be outsourced.

It’s important to note that a PEO does not handle staffing or provide employee leasing services. Your HR department retains its responsibilities for recruitment and hiring.

Is a PEO the same as an EOR?

No, a PEO and an Employer of Record (EOR) differ in their structure, roles and responsibilities.

PEOs: For international companies with established US subsidiaries and bank accounts, PEOs may be a cost-effective solution. They co-employ your US staff, assuming responsibility for tasks like payroll, benefits administration, and compliance with federal and state regulations, including tax laws. However, remember that the key requirement for a PEO is your existing US entity and bank account.

EORs: However, if you don’t have a US entity, EORs offer a vital alternative. They act as the legal employer of record for your US staff, handling all employment-related matters while you focus on core business functions. EORs are invaluable for international companies seeking flexibility and speed in building a US team without establishing their own entity. With Foothold America as your EOR, you can easily onboard and manage US employees without the hassle of setting up a US company or dealing with complex hiring regulations.

Read more: PEO vs EOR for Business Expansion

What are the advantages and disadvantages of a PEO?

Advantages of utilising a PEO

- Eases the burden of various HR responsibilities for your business

- Provides support for domestic compliance in which the PEO operates.

- Strengthens your domestic HR operations

- Ability to provide competitive employee benefits

Disadvantages of using a PEO

- Loss of Control: By outsourcing HR functions to a PEO, companies may lose some control over essential processes and people within the organization.

- Quality of HR Services: Some companies report that the quality of HR services provided by a PEO may not meet their expectations or the specific needs of their business.

- Compliance Concerns: Although PEOs can assist with compliance-related tasks, ultimate responsibility still lies with the employer. It’s essential to ensure that adequate measures are in place to maintain compliance with labor laws and regulations.

- Limited Access to HR: Employees may have limited access to HR professionals under a PEO arrangement, as these professionals serve multiple client organizations.

- Data Accessibility: Company data may reside with the PEO, which could result in delayed or limited access for the employer. It’s crucial to establish clear communication and data-sharing protocols with the PEO.

PEOs operating in the United States have the option to attain accreditation. The CPEO program, administered by the IRS (Internal Revenue Service), offers certification to PEOs. Additionally, the ESAC (Employer Services Assurance Corporation) acts as an independent third-party accreditation provider. In the US, PEOs typically join the NAPEO (National Association of Professional Employer Organizations) as members.

Beyond PEO: Introducing Foothold America's PEO+ Cross-Border Support™

While Professional Employer Organizations (PEOs) offer a valuable service for US businesses, international companies establishing or expanding their presence in the US face unique challenges. Traditional PEOs, though helpful, may only address some of the intricacies in navigating the US employment landscape.

This is where Foothold America’s innovative PEO+ Cross-Border Support™ comes in. PEO+ builds upon a PEO’s core strengths by offering an additional layer of Cross-Border Support™. This specialized service tackles the specific needs of international businesses, ensuring a smooth and successful US market entry.

Here’s why PEO+ is the perfect solution for your international business.

- Streamlined Operations: Like a traditional PEO, PEO+ takes care of comprehensive employee payroll, tax management, benefits administration, and worker’s compensation insurance. But we go beyond the basics. We handle the recurring time-intensive tasks associated with these processes, freeing you to focus on core business activities and providing relief and freedom.

- Expert US Market Guidance: PEO+ offers in-depth HR guidance, compliance assistance, and best practice recommendations. We go the extra mile by assisting with employee classification and navigating complex employee terminations.

- Tailored Support for International Businesses: PEO+ understands the challenges of establishing a US workforce. We provide cross-border support, including registration in new states as you expand your operations. We evaluate private market options to ensure you get the best rates on benefits and insurance, offering you a comprehensive support system that guides you every step of the way.

- Frictionless Onboarding: We handle the setup and ongoing management of our easy-to-use online portal, providing you and your employees with a centralized hub for accessing important information.

In short, PEO+ streamlines your US operations, provides expert guidance, and offers targeted support designed for international businesses. With PEO+, you can confidently navigate the US employment landscape, minimize administrative burdens, and maximize your chances of success in the US market.

PEOs and Beyond - Exploring Your Options

This guide has explored the world of PEOs and how they can act as a valuable partner for businesses, particularly those looking to streamline HR tasks and access benefits packages. However, PEO+ by Foothold America offers an even more comprehensive solution for international companies venturing into the US market.

PEO+ builds upon the core strengths of a PEO by providing Cross-Border Support™. This specialized service tackles the unique challenges faced by international businesses, ensuring a smooth and successful US market entry. If you’re an international company looking to expand your reach in the US, consider PEO+ as your one-stop shop for navigating US employment regulations, managing HR tasks, and maximizing your chances of success.

For more information about PEO+ and how it can benefit your international business, contact Foothold America today!

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.