For international companies expanding to the United States, an Employer of Record (EOR) service offers a streamlined solution for hiring employees without establishing a legal entity. However, the contract governing this relationship can significantly impact your experience, costs, and overall success in the US market.

“The EOR contract sets the rules of engagement for one of your most critical business relationships during US expansion,” explains Joanne Farquharson, President and CEO of Foothold America. “It’s important to thoroughly review the contract as it specifies key details about the worker relationship that will impact your operations months later when you’re established with the provider.”

As EOR services are popular among international businesses, understanding contract terms has become increasingly important. Recent industry research indicates that EOR adoption increased by 27% in 2024-2025, with over 65% of international companies considering an EOR for their initial US market entry. This growth has led to more complex and varied contract structures across providers, so careful review is essential before signing.

While many EOR providers attempt to cover multiple countries with varying levels of expertise, Foothold America stands apart with our exclusive focus on the United States. This specialized approach means we offer unparalleled expertise in US employment law, tax regulations, and compliance requirements across all 50 states. This US-focused specialization for international companies translates to contracts that provide better protection and more favorable terms tailored to the American market.

This comprehensive guide explores the critical contract terms every business should evaluate, identifies potential red flags, and provides practical guidance to secure favorable terms that protect your interests while supporting your US expansion goals.

Essential EOR Contract Terms to Evaluate

Before signing an EOR agreement, carefully review these key contract components to ensure they align with your business needs and expansion plans.

1. Scope of Services & Responsibilities

What to look for:

Clear understanding of how employment responsibilities are managed, including

- Who manages the employee onboarding and offboarding processes

- How payroll processing and tax filings are handled

- How benefits administration and enrollment are coordinated

- Which party oversees HR compliance responsibilities

- The approach to employee relations management

Red flags:

- Lack of clarity about service expectations and deliverables

- Absence of specific timelines for key processes

- No clear communication channels for resolving questions about responsibilities

- Insufficient information about how compliance matters are handled

- Confusion regarding the roles of each party in managing employment functions

Many EOR contracts contain ambiguous language about who handles which employment responsibilities. To avoid potential misunderstandings about service scope within your EOR relationship, ensure your contract clearly identifies who is responsible for each aspect of employment management.

2. Fee Structure & Pricing Transparency

What to look for:

- Clearly defined base fees and calculation methods

- Transparent disclosure of all potential additional charges

- Historical pricing trends and stability

- Volume discounts for larger employee counts

- Clear examples of total cost scenarios

Red flags:

- Complex pricing models with multiple variables

- Undefined “administrative fees” or “processing fees”

- Unlimited right to increase fees with minimal notice

- Percentage-based models without caps

- No employee budget projections showing estimated total employment costs

The most common EOR pricing models include:

Pricing Model | How It Works | Pros | Cons |

Flat Fee Per Employee | Fixed monthly amount per employee | Predictable, scales well | Can become expensive with high employee count |

Percentage of Payroll | Fee calculated as percentage of total payroll | Aligns with actual salary costs | Can become expensive with higher salaries |

Tiered Pricing | Rates decrease with more employees | Cost-effective for growth | Complex to calculate initially |

Base Plus Variable | Core fee plus add-ons | Customizable | Can lead to unexpected costs |

“In our experience, the most transparent EOR providers offer clean, straightforward pricing with minimal variables,” notes Angelique Soulet-Bangurah, Head of EOR Services at Foothold America. “We’ve seen companies face unexpected costs of 15-30% above initial estimates due to contract fine print and undisclosed fees.”

3. Termination Provisions & Exit Strategy

What to look for:

- Reasonable notice periods (ideally 30-60 days)

- A transparent process for transitioning employees

- Fair and clearly defined termination fees

- Data transfer protocols upon termination

- Post-termination support options

Red flags:

- Long notice periods (90+ days)

- Excessive early termination penalties

- Automatic renewal clauses with narrow cancellation windows

- Ambiguous language about data ownership

Exiting an EOR relationship efficiently becomes crucial as your US operations evolve. Working with providers who offer both EOR and other hiring models creates a more streamlined transition as your company grows. According to recent industry data, approximately 42% of companies shift from an EOR to another employment model, such as a PEO, within 2-3 years as their US presence matures. Without favorable termination provisions, this transition can become unnecessarily costly and disruptive.

4. Service Level Agreements (SLAs)

What to look for:

- Defined response times for inquiries and issues (expect it to be within 24 hours)

- Clear escalation procedures

- Performance metrics with consequences for non-compliance

- Regular service review mechanisms

- Dedicated account management specifications

- Communication protocols for different situations

- Specified HR manager assignment for personalized support

Red flags:

- Absence of measurable service standards

- One-way accountability (yours, not theirs)

- Vague promises without specific commitments

- Limited availability in your time zone

- Anonymous support teams rather than dedicated contacts

Effective SLAs protect your business from poor service that could impact your employees and operations. A well-structured SLA creates accountability, establishes clear expectations for performance, and provides remedies if services fall below agreed standards. Beyond just metrics, the most valuable SLAs establish a framework for ongoing communication and relationship management, ensuring your EOR partner remains responsive to your evolving needs throughout your US expansion journey.

5. Compliance Guarantees & Liability Allocation

What to look for:

- Explicit compliance guarantees with major employment laws

- Clear liability allocation for tax-related matters

- Indemnification provisions that protect your company

- Verification of the EOR’s appropriate insurance coverage

- Compliance expertise across all relevant states

Red flags:

- Minimal insurance coverage

- Caps on liability that are inappropriately low

- Mandatory arbitration clauses with unfavorable terms

- Excessive restrictions on employee transitions

- Unclear remedies for service failures

The primary value proposition of an EOR is compliance expertise and risk mitigation. Your contract should reflect this by placing appropriate responsibility on the EOR for compliance matters within their control. According to US Department of Labor statistics, employment compliance violations resulted in an average penalty of $43,800 per incident in 2024 – costs your contract should protect you from bearing.

Beyond the Basics: Advanced Contract Considerations

While the fundamental terms above form the core of any EOR agreement, sophisticated international companies should also evaluate these additional contract elements for comprehensive protection.

6. Benefits and Insurance Flexibility

What to look for:

- Clear process for accessing standard benefits information

- Transparent costs for benefits administration

- Understanding of how benefits decisions are made

- Awareness of regulatory limitations on benefits customization

- Regular communication about benefits updates

Red flags:

- Lack of clarity about available benefits options

- No proactive communication about benefits changes

- Hidden charges for benefits administration

- Unrealistic promises about benefits customization that may conflict with legal requirements

Recent trends show significant regional variations in benefits expectations across the US. Consider whether your EOR contract provides the flexibility to offer competitive benefits in your specific industry and location. As healthcare costs continue to evolve and employee expectations shift, the ability to adapt your benefits strategy becomes increasingly valuable. The right EOR contract should allow for adjustments to your benefits approach as market conditions change and your US presence matures.

7. Geographic Coverage & Expansion Support

What to look for:

- Specific states or regions covered by the agreement

- Process for adding employees in new states

- Transparent costs for multi-state expansion

- Support for different employment models (remote, hybrid, office-based)

- Specialized knowledge of state-specific regulations

- US-focused expertise rather than diluted global coverage

Red flags:

- Limited geographic coverage without transparent expansion options

- Significant surcharges for certain states

- One-size-fits-all policies, regardless of location

- Lack of state-specific compliance expertise

- Hidden costs for supporting different work models

- Global providers with superficial US market knowledge

“Many international companies don’t realize the significant variation in employment laws across US states,” notes Angelique Soulet-Bangurah. “An EOR contract that treats California the same as Texas may indicate a lack of sophisticated compliance infrastructure. Unlike global providers who spread their attention across dozens of countries, Foothold America’s exclusive US focus ensures we have deep expertise in every state’s unique requirements, which is reflected in our more precise and protective contract terms.”

Red Flag Contract Clauses to Avoid

Beyond evaluating essential terms, be alert for these problematic contract provisions that could create significant issues:

1. Absence of Dedicated HR Support

The risk: Many EOR contracts, particularly from global providers, offer only portal-based or rotating support teams rather than dedicated HR professionals who understand your unique business needs and challenges.

What to look for instead: Contract terms guarantee a dedicated HR manager who is your consistent point of contact, understands your business and provides personalized support throughout your US expansion journey. At Foothold America, every client is assigned a dedicated HR manager who works alongside our US team to provide seamless support.

2. Lack of State-Specific Expertise

The risk: Some EOR contracts contain generic compliance language that fails to address the specific requirements of individual US states where your employees will be located, creating potential regulatory exposure.

What to look for instead: Specific provisions demonstrating the provider’s expertise in each state’s unique employment laws, tax regulations, and compliance requirements. As a US-focused specialist, Foothold America’s contracts include state-specific protections rather than one-size-fits-all global terms.

3. Unreasonable Non-Solicitation Clauses

The risk: Overly broad non-solicitation provisions might prevent you from directly hiring your EOR-employed team members even after the contract ends, forcing ongoing dependency on the EOR.

What to look for instead: Time-limited non-solicitation clauses (maximum 6-12 months) with exceptions for mutual agreement or employee-initiated applications.

4. Hidden Fee Escalators

The risk: Some contracts include automatic fee increases based on inflation, benefit costs, or regulatory changes without caps or transparency.

What to look for instead: Clear limitations on fee increases (e.g., maximum 3% annually) with advance notice requirements and options to terminate if increases exceed certain thresholds.

5. Employee Transfer Restrictions

The risk: Some contracts impose significant barriers to transitioning employees away from the EOR, such as excessive fees or procedural hurdles.

What to look for instead: Clear, reasonable processes for employee transitions with transparent, fair costs that reflect actual administrative expenses rather than punitive charges.

The Advantage of US-Focused EOR Expertise

When evaluating EOR providers and their contracts, the distinction between global providers and US specialists becomes increasingly essential. Many international companies initially gravitate toward global EOR providers, assuming broader coverage equals better service. However, this approach often has significant disadvantages when expanding to the United States.

“The US employment landscape is uniquely complex compared to most countries,” explains Joanne Farquharson. “With 50 different states, each with their employment laws, tax regulations, and compliance requirements, proper US expansion requires deep, specialized expertise rather than surface-level global coverage.”

Compare Foothold America’s US-focused approach to global providers →

Foothold America’s exclusive focus on the US market provides several distinct advantages that are reflected in our contract terms:

- State-Specific Compliance Guarantees: Unlike global providers who often use general compliance language, our contracts include specific protections relevant to each state where you operate.

- More Precise Risk Allocation: Our contracts delineate responsibilities based on US employment law rather than generic international standards.

- Absence of Cross-Border Complexity: Contracts from global providers often contain unnecessary provisions addressing international transfers and multiple legal jurisdictions, creating confusion and potential conflicts.

- Transparent US-Specific Pricing: Our fee structures reflect the actual costs of US employment without hidden margins for international service coordination.

- Specialized US Support Commitments: Our SLAs are built around US business hours and regulatory timelines rather than compromising across multiple time zones.

Building a Successful EOR Relationship Beyond the Contract

While a well-structured contract provides essential protection, the success of your EOR relationship ultimately depends on ongoing management and communication. Implement these best practices regardless of your contract terms:

1. Establish Regular Review Meetings

Schedule quarterly service reviews to evaluate performance against SLAs, discuss any issues, and align on upcoming needs or changes.

2. Document Everything

Maintain detailed records of all communications, particularly regarding service issues, special requests, or verbal agreements that supplement the written contract.

3. Develop Internal Expertise

Designate team members to develop expertise in US employment practices and EOR management, reducing your dependency on the provider for basic information.

4. Plan for Evolution

Assess regularly whether your EOR relationship continues to meet your evolving needs as your US presence grows, and prepare well in advance for potential transitions.

5. Build Relationships Beyond Account Managers

Develop connections with multiple stakeholders at your EOR provider, including operations personnel and executives, to ensure continuity if your account manager changes.

Conclusion & Next Steps

The right EOR contract forms the foundation for a successful US expansion, providing protection against potential risks and a framework for productive collaboration. By carefully evaluating the terms discussed in this guide, you can avoid common pitfalls and secure an agreement that supports your business objectives.

“An EOR contract isn’t just a legal document—it’s a blueprint for one of your most important business relationships during US market entry,” emphasizes Joanne Farquharson. “The time invested in securing favorable terms with a true US specialist pays dividends throughout your expansion journey.”

Unlike global providers who spread their attention across dozens of countries with varying levels of expertise, Foothold America’s exclusive focus on the United States ensures we provide unmatched knowledge of US employment law, tax regulations, and compliance requirements. This specialized approach is reflected in our contracts, which offer superior protection explicitly tailored to the unique complexities of the American market.

Ready to navigate the complexities of EOR contracts for your US expansion? Foothold America provides specialized expertise in US employment solutions for international companies, with transparent agreements designed to protect your interests while supporting your growth objectives. Contact us today to discuss how our experienced team can help you secure the optimal EOR arrangement for your unique needs.

Frequently Asked Questions: EOR Contracts for US Expansion

Get answers to all your questions and take the first step towards a US business expansion.

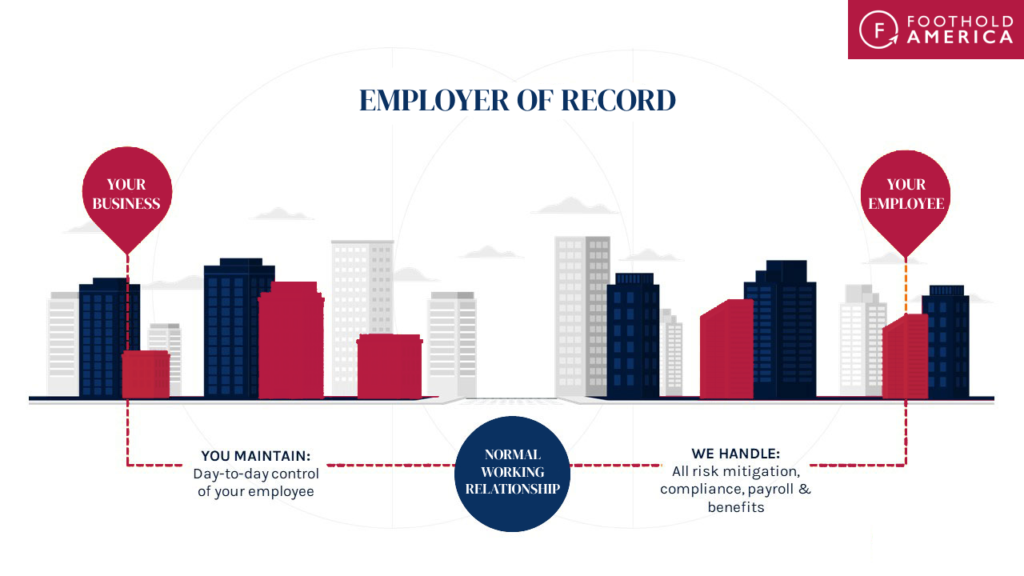

An employer of record (EOR) serves as the official employer for your workers in a new territory, taking care of employment contracts, payroll, and compliance with local laws. While your company maintains day-to-day management of employees, the EOR is the legal employer on paper, handling paperwork, tax filings, and ensuring compliance with social security and unemployment insurance requirements. This arrangement allows international companies to hire in the US without establishing their own entity, which is particularly valuable when expanding into new markets.

When using an EOR for international hiring, the process typically begins with your company identifying the talent you wish to hire. The EOR then manages the formal aspects of the hiring process, including drafting employment agreements, conducting background checks where appropriate, and processing new hire documentation. Your company maintains control over selecting candidates and determining job responsibilities, while the EOR handles compliance with local authorities and employment regulations. This collaborative approach streamlines your entry into new markets while ensuring all legal requirements are met.

An EOR typically provides access to health insurance and other benefits for your employees. The EOR’s contract should clearly outline how benefits administration is coordinated, including how employees enroll in health plans and what options are available. It’s important to understand that benefits options may be constrained by legal requirements to ensure fairness across all employees. The best EORs provide transparent information about benefits, regular updates about any changes, and clear communication about how benefits decisions are made within regulatory requirements.

A quality EOR service should scale efficiently as your number of employees increases. Look for providers that offer streamlined processes regardless of team size and transparent pricing that potentially becomes more advantageous as your global team grows. The best EORs provide dedicated support even as your workforce expands and can accommodate growth across different states. Additionally, some providers offer various employment models beyond EOR (such as PEO) that can provide a better fit as your company matures in the market, making transition smoother when you reach a size where establishing your own entity becomes advantageous.

The key differences between EORs and professional employer organizations (PEOs) center around structure, requirements, and appropriate timing. An EOR becomes the official employer of your workers, requiring no legal entity in the US, making it ideal for initial market entry. A PEO, meanwhile, operates through a co-employment model where your company maintains its own entity and shares employer responsibilities. EORs provide faster market entry with minimal setup, while PEOs typically offer more customization and can be a better option as your US presence matures. Many companies start with an EOR and transition to a PEO or their own entity as they establish themselves in new markets.

Read more: EOR vs PEO

When using an EOR service, your company maintains day-to-day management control over employees, including work assignments, performance management, and professional development. The EOR handles administrative aspects like generating payslips, managing tax withholdings, and ensuring compliance with employment regulations. While the EOR is the legal employer on paper, your company retains full control over business operations and employee work products. The employment agreement should clearly outline this relationship to prevent misunderstandings. For companies seeking absolute full control over all employment aspects, establishing your own entity would eventually be necessary.

When reviewing an EOR contract, pay special attention to terms regarding length of employment and employee transitions. Look for reasonable notice periods (ideally 30-60 days) and a clear process for transferring employees if you decide to establish your own entity or switch providers. The contract should contain fair and clearly defined termination fees and explain data transfer protocols upon termination. Work with providers who offer both EOR and other hiring models to create more streamlined transitions as your company grows. This flexibility becomes crucial as approximately 42% of companies shift from an EOR to another employment model within 2-3 years as their US presence matures.

Read more: Choosing the best Employer of Record

Employers of record (EORs) enable companies to hire talent in a new country without establishing a local entity in each particular country. Unlike working with international contractors, using an EOR ensures employees are hired in accordance with all local employment laws and regulations. This approach is particularly valuable for building a global team while minimizing legal risks. Companies can focus on recruiting the best talent while the EOR takes on employment compliance responsibilities. For companies specifically targeting US expansion, working with a US-focused EOR rather than a global provider offers deeper expertise in the complex American regulatory landscape.

Most EORs do not take full responsibility for visa procurement but can provide valuable guidance on visa requirements and processes. When hiring employees who need work authorization, the EOR contract should clearly outline what assistance is available for visa applications and compliance. Some EORs offer coordination with immigration attorneys or provide documentation needed for visa processes. Before signing with an EOR, international companies should confirm the level of visa support provided and whether additional costs apply. Companies planning significant international hiring should look for EORs with established processes for navigating work authorization requirements.

When transitioning from an EOR arrangement to your own local entity, the employee’s contract typically needs to be transferred or terminated and replaced. The EOR contract should include clear provisions for this transition, outlining notice periods, data transfer protocols, and any associated fees. Working with providers who offer both EOR and other employment models often creates a more streamlined transition process. The best EOR contracts include reasonable notice periods (ideally 30-60 days) and fair termination provisions that facilitate rather than hinder your growth. This transition flexibility is particularly important as many companies eventually establish their own entity to gain more control over employment relationships as their US operations mature.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.